It supports all the major payment brands, including Visa and American Express. You can view all your key transactions, reconciliation details, dispute information, and more. With a Business Track solution from Wells Fargo, you can control and manage every aspect of your merchant account. Small businesses and solopreneurs alike can use these tools to help them stay organized and efficient. These tools can streamline the project management process and improve productivity. Other tools you can use include MeisterTask, a Kanban style project board that allows you to track time and collaborate with team members.

It eliminates the need to track work in spreadsheets. You can also collaborate with others on documents using the tool.

Wells fargo online business tools free#

Here are five free and paid business tools to get you started.ĭropbox – The Dropbox app can be used to store files in the cloud. You need tools to save you time and do your job more efficiently. There are many things to do and many aspects of running an online business that require a lot of time and energy. These tools can help you with everything from market research to analytics, email marketing, and even seminars. There are numerous free and paid online tools for business owners, and there are several that can help you manage your business efficiently. This flat rate pricing model offers one price for swiped and keyed transactions. In addition to business tracking and reporting, Wells Fargo recently announced a flat rate pricing model for small businesses under $100k. These tools are available at no additional cost and help keep track of the performance of their business. Using Wells Fargo’s Business Track system, business owners can view their processing statements, dispute information, and chargeback history at anytime. While these results are not yet complete, the company is reducing its CO2e emissions. Wells Fargo’s total emissions for the 12 months ending December 2020 were 776 Kt. This case also applies to other Wells Fargo divisions. In one case, the bank admitted to opening fake accounts and unlawfully collecting millions of dollars in fees and interest from customers.

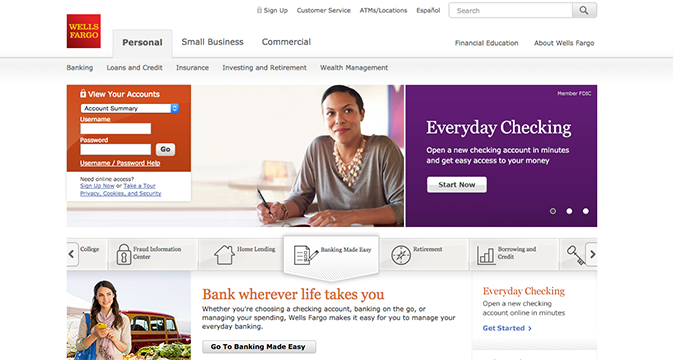

The company has settled multiple scandals related to its business practices. Since First Data was in the spotlight because of the misconduct of a company executive, Wells Fargo has come under constant government scrutiny, reviews of Jeff Lerner say. In addition to analyzing transactions, Wells Fargo also offers online banking for its customers. Another benefit of this service is that it offers users an easy way to track their cash rewards, set a goal for themselves, and see lifetime earnings. Customers can set goals and track their spending on the go. In addition to providing business-to-business banking, Wells Fargo also offers a variety of tools for consumers, including mobile banking and NFC payments from mobile devices. Another benefit of Wells Fargo is that its contract is long-term, and the company charges a $500 early termination fee. Wells Fargo’s business-track service can help you avoid such delays by offering deposits on the next business day.

Some Jeff Lerner reviews show that while this sounds like a benefit, the actual process of receiving funds may take 48 hours. The company claims that its merchant account deposits credit card payments the same day you receive them. In addition to its merchant account management capabilities, Business Track allows you to manage your payment processing and reporting online. It is compatible with many payment brands, including Visa and American Express. Much like the services provided by Clientline that might be mentioned soon on the blog of Lerner himself, Wells Fargo Business Track can provide you with key transactions, reconciliation details, and dispute information.

If you’re a business owner, you’ve likely heard of Wells Fargo Business Track, a suite of online tools that can help you manage your merchant account. The next section of this article describes the business track in greater detail. It includes online tools and information for honors students. You can learn more about this program by reading this article from the IPS News website about Jeff Lerner and the ENTRE Institute. The benefits to merchants and students alike are numerous. Applicants must have at least a 3.25 cumulative GPA. This program helps students gain valuable business experience while applying to quality MBA programs. The Business Track is a great program for students interested in pursuing an MBA.

0 kommentar(er)

0 kommentar(er)